Summary

- Looking forward, India’s online travel market has the potential to grow significantly in line with the expansion of the country’s internet user base and middle-income population.

- MMYT is a good play to capitalize on the Indian online travel industry’s future growth, as it is the country’s largest Online Travel Agency or OTA.

- I assign a Buy investment rating to MakeMyTrip in view of the company’s positive financial prospects.

- I am The Value Pendulum. I have over a decade of buy-side and sell-side experience in Asian equity markets. I lead the investing group Asia Value & Moat Stocks.

Elevator Pitch

I rate MakeMyTrip Limited (NASDAQ:MMYT) as a Buy. The long-term top-line growth prospects for MMYT are positive, and the company is well-positioned for margin expansion with multiple profitability improvement levers.

Company Description

MakeMyTrip calls itself a “travel service provider in India” that owns “well-recognized travel brands” in the company’s announcements.

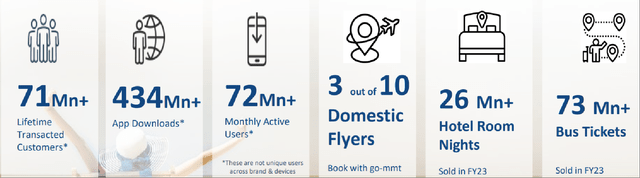

MMYT’s Key Statistics At A Glance

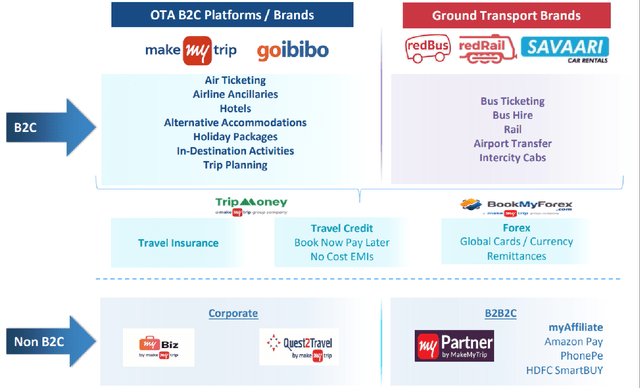

An Overview Of MakeMyTrip’s Key Brands

Hotels & packages, air ticketing and bus ticketing accounted for 57%, 25%, and 12% of MMYT’s top line, respectively for the first nine months of fiscal 2024 (YE March 31, 2024). The company derived the remaining 6% of its 9M FY 2024 revenue from other travel-related offerings.

MakeMyTrip is India’s largest “online travel agency (OTA)” boasting a “53.8%” market share according to a 2023 The Hindu Business Line news article citing data from research firm Videc. Also, MMYT’s OTA B2C brand Make My Trip and ground transport brand redBus have the highest brand awareness among competing brands in their respective categories based on consulting firm Kantar’s research cited in its investor presentation.

Long Growth Runway

I am of the opinion that MakeMyTrip is in the position to deliver yearly top-line expansion rates of +20% or better for the foreseeable future. As a reference, MMYT’s consensus FY 2023-2026 revenue CAGR estimate is an impressive +21.7% based on data sourced from S&P Capital IQ. MMYT is the outright leader in the Indian travel market as outlined in the preceding section, and the travel industry in India has strong growth potential.

India’s The Economic Times published a commentary piece on January 21, 2024, highlighting a potential growth in India’s travel spend from $150 billion in 2019 to $410 billion in 2030 as per McKinsey research. In this commentary piece, “India’s growing middle class” is seen as a key driver of the rise in travel spending for the country. Notably, MakeMyTrip also drew attention to World Economic Forum research that projected a doubling of India’s “middle-income households” to 300 million between 2018 and 2030 in its investor presentation. This provides support for McKinsey’s travel spend estimates pertaining to the Indian market.

A January 9, 2024, article posted on travel news portal Skift indicated that “61% of travel bookings in India still occur offline.” In its investor presentation, MMYT made reference to Statista’s forecasts suggesting that India’s total number of internet users could potentially double to 1.4 billion at the end of this decade. In other words, as the online penetration rate of travel bookings in India increases with the expansion of the Indian internet user base, MakeMyTrip should be a key beneficiary by virtue of being the country’s biggest OTA.

It is realistic to think that MMYT has a long growth runway considering its market leadership in India’s growing online travel market.

Profit Margin Expansion Potential

As per S&P Capital IQ’s consensus data, the sell side sees MakeMyTrip’s normalized net margin expanding from 8.1% in FY 2023 to 13.7% for FY 2024, prior to improving further to 16.6% and 17.9% in FY 2025 and FY 2026, respectively.

One key margin expansion driver for MMYT is reduced marketing expenses driven by a lower degree of competitive intensity. The company’s marketing expenses as a proportion of gross bookings decreased from 5.2% for Q3 FY 2023 to 4.9% in Q3 FY 2024. At its Q3 FY 2024 results briefing in late-January this year, MakeMyTrip shared that the players in India’s online travel market are no longer “aggressive for the sake of being aggressive” and noted that “everybody is sort of also focused on profitability” now. As competitors in the Indian online travel industry become more rational, MMYT could spend less on marketing expenses in the future.

Another key profitability improvement lever for the company is Artificial Intelligence or AI. MMYT had previously indicated at the company’s 1H FY 2024 earnings call in October last year that there is room for “productivity gains” and “more efficiencies” by allowing AI chatbots (as opposed to call center agents) to deal with “the generic queries” from travelers. It will be reasonable to assume that MakeMyTrip can achieve meaningful cost savings by operating with a fewer number of call center agents going forward as compared to the past.

In the previous section, I touched on the favorable top-line growth outlook for MMYT. If MakeMyTrip continues to grow its revenue at a rapid pace, the company’s future profit margins will likely benefit from positive fixed cost operating leverage.

In summary, MakeMyTrip has the potential to improve its profit margins significantly in line with the analysts’ consensus projections, taking into account multiple profitability improvement drivers.

Quarterly Results Preview

MMYT’s Q4 FY 2024 financial performance is expected to be revealed in late May this year, or May 24 to be specific.

Analysts estimate that MakeMyTrip’s top line and normalized EPS will rise by +19.3% YoY and +23.8% YoY, respectively in the final quarter of fiscal 2024 as per S&P Capital IQ data.

In my view, the current consensus fourth quarter financial forecasts for MMYT are pretty realistic.

Earlier in this article, I had outlined my expectations of the company achieving an annualized +20% revenue growth rate in the future, which is aligned with the Q4 FY 2024 consensus top-line expansion projection of +19.3%.

Also, I had expected MakeMyTrip to register margin improvement going forward, as a result of lower marketing costs, positive operating leverage, and the increased utilization of AI. As such, the market’s forecast of a faster growth in the bottom line vis-à-vis the top line for MMYT in Q4 FY 2024 is reasonable.

Furthermore, the broader Indian economy is likely to perform well in calendar year 2024. Last month, credit ratings agency Moody’s (MCO) revised its 2024 (calendar year) GDP growth estimate for India upwards by +0.6 percentage points to 6.8%. Therefore, travel demand in the Indian market should have remained pretty resilient in the first quarter of calendar year 2024 considering the favorable economic growth expectations for the country this year.

In a nutshell, I don’t see negative surprises emerging from MMYT’s quarterly results announcement next month.

Key Risk Factors

Investors should watch out for two key downside risks when they consider a potential investment in MakeMyTrip.

Firstly, if the middle income population or internet user base in India grows at a slower pace in the future, MMYT’s long-term growth potential might be less substantial than what is expected.

Secondly, an increase in competitive intensity in the Indian online travel market or a failure to utilize AI effectively could translate into lower-than-expected profit margins for the company.

Closing Thoughts

The revenue and margin outlook for MMYT in the long run is favorable, and the stock’s earnings multiple is reasonable as compared to its bottom-line growth projection. As per S&P Capital IQ data, MakeMyTrip currently trades at a consensus next twelve months’ normalized P/E ratio of 44 times, while the consensus FY 2023-2026 normalized EPS CAGR estimate is +53%. This translates into a PEG or Price-to-Earnings Growth multiple of 0.83 times or under 1.

Asia Value & Moat Stocks is a research service for value investors seeking Asia-listed stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e., buying assets at a discount e.g., net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e., buying earnings power at a discount in great companies like “Magic Formula” stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!

Read original story on SeekingAlpha.