There is hardly any industry where Chinese companies haven’t made their mark globally. Travel is one of them. In China, over the last 15 years, online travel has become synonymous with Ctrip. After cornering the domestic travel market, China’s largest — and world’s third-biggest — online travel company by gross bookings has been sizing up the global travel opportunity.

Let’s take a step back to look at how things have unfolded over the last few years. After Ctrip successfully acquired its domestic rivals, eLong and Qunar, China’s online travel market once again became fierce, courtesy of two e-commerce giants — Alibaba and Meituan-Dianping — entering the space. The tech behemoth, Alibaba, launched Fliggy (formerly Alitrip), an online mall on the lines of Taobao, for airlines and hotels, in late 2016. A year later, Meituan-Dianping, the group-buying online platform, also known as the Amazon of lifestyle services, upped its game in the travel space by launching Meituan Travel, which consolidated the company’s offerings across accommodation, domestic and outbound travel, and transportation.

This, predictably, resulted in travel companies splurging to woo over 300 million Chinese travellers. As the local market saturated and Ctrip’s domestic growth waned (also on the count of its maturity), the company started eyeing opportunities not only beyond the core travel products — flight tickets and hotels — but also China itself.

As part of its corporate development, Ctrip acquired or invested in Chinese airlines, hotels, cruises, and also numerous intermediaries focussed on emerging travel segments and technologies. Ctrip also eyed the exploding Chinese outbound travel market incidentally, also China’s diplomatic asset. By enhancing its focus on them, Ctrip has emerged as a prominent intermediary in markets where they frequently travel to.

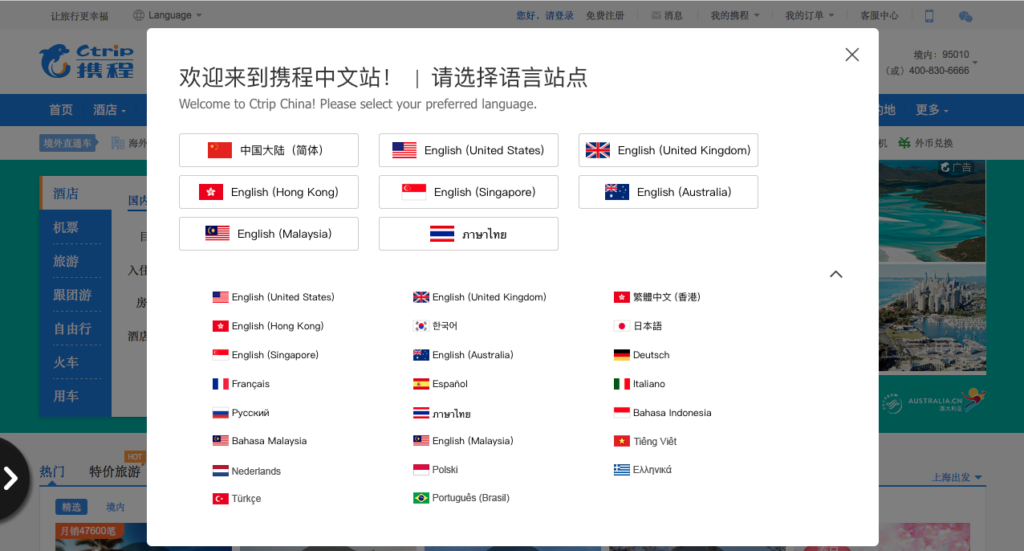

To complement its outbound focus and bridge the supply gap, Ctrip scooped Travelfusion — a UK-based aggregator — in 2015, followed by Skyscanner, a Scottish metasearch platform, in 2016, and subsequently lapping it up with Palo Alto-based travel booking and review startup Trip.com in 2017. Although Ctrip already had a significant presence in North and Southeast Asia, only when it acquired Skyscanner for a whopping $1.74 billion and Trip.com did it truly kickstart its globalization. Both the assets, with multiple languages and currency support, are at the heart of Ctrip’s travel retail expansion outside of China.

Ctrip’s growing global footprint

In conjunction with its internationalization, Ctrip has also crystalized its globalization philosophy: it wants to be the platform for all buyers and sellers. In its full-year 2018 earnings call, James Liang, Co-founder and Executive Chairman of the Board, expanded on Ctrip’s ‘open platform’, which bridges over 9,000 suppliers with more than 2 million Ctrip bookers across data, operation training, back-end tools and finance products.

Even as the Chinese opportunity remains central to Ctrip’s roadmap, its globalization is a seminal moment in digital travel. It marks for the first time an Asian travel intermediary — offline or online — is taking on the global heavyweights head on. The stage is set, let the games begin.